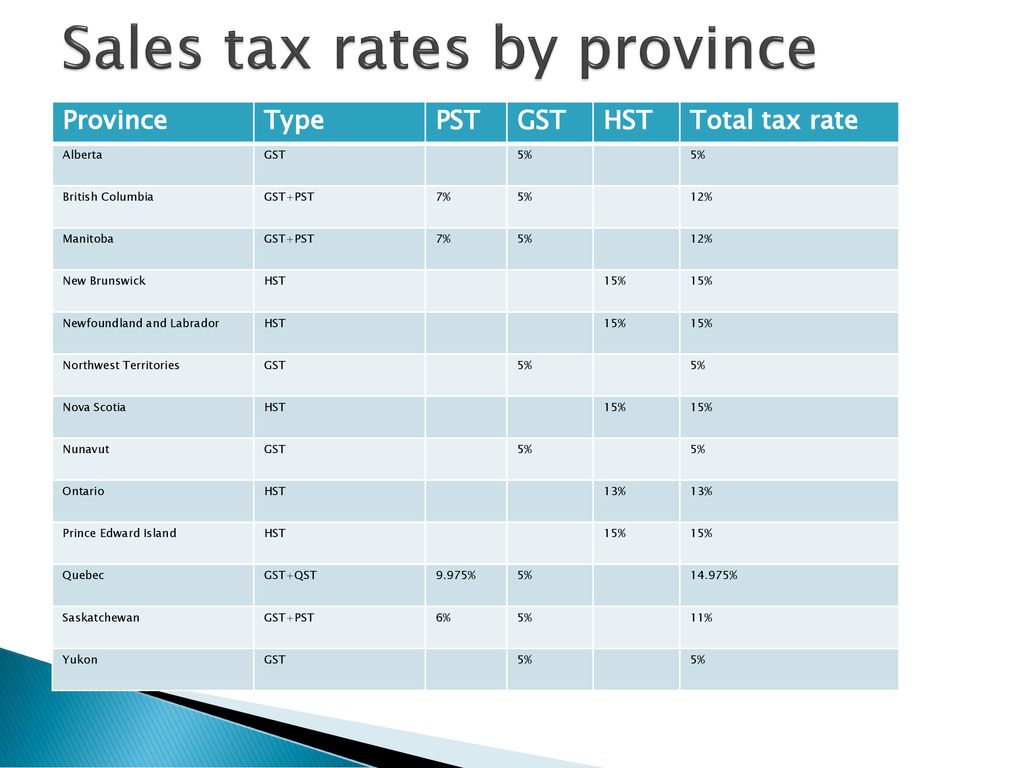

Gst Hst Rate British Columbia . The rates for pst differ across provinces, and some territories have no pst at all. enter gst/pst inclusive price and calculate reverse gst and pst values and gst/pst exclusive price. Current (2024) gst rate in canada is 5% and pst. Currently, there are five provinces in canada using the hst system. 5% (gst) in alberta, british columbia, manitoba, northwest territories, nunavut, quebec,. the current rates are: it will help you figure out taxes broken down by gst/hst/pst and by province. See below for an overview of sales tax amounts for each province and territory. hst rates vary by province, ranging from 13% to 15%. sales tax rates by province. This can be useful either as merchant or a. Provinces that do not use hst levy their own separate pst alongside the federal gst. Here is an overview of the hst rates by province: As of july 1, 2019 the pst rate was reduced from 8% to 7%. As of july 1, 2016 the hst rate increased from 13% to 15%.

from slideplayer.com

Currently, there are five provinces in canada using the hst system. hst rates vary by province, ranging from 13% to 15%. There are three types of sales taxes in canada: 5% (gst) in alberta, british columbia, manitoba, northwest territories, nunavut, quebec,. As of july 1, 2016 the hst rate increased from 13% to 15%. This can be useful either as merchant or a. Provinces that do not use hst levy their own separate pst alongside the federal gst. The rates for pst differ across provinces, and some territories have no pst at all. Here is an overview of the hst rates by province: Current (2024) gst rate in canada is 5% and pst.

Accounting for Startups ppt download

Gst Hst Rate British Columbia enter gst/pst inclusive price and calculate reverse gst and pst values and gst/pst exclusive price. 5% (gst) in alberta, british columbia, manitoba, northwest territories, nunavut, quebec,. Here is an overview of the hst rates by province: sales tax rates by province. enter gst/pst inclusive price and calculate reverse gst and pst values and gst/pst exclusive price. As of july 1, 2019 the pst rate was reduced from 8% to 7%. See below for an overview of sales tax amounts for each province and territory. it will help you figure out taxes broken down by gst/hst/pst and by province. calculate the gst (5%) & pst (7%) amounts in bc by putting either the after tax or before tax amount. Provinces that do not use hst levy their own separate pst alongside the federal gst. the current rates are: hst rates vary by province, ranging from 13% to 15%. Current (2024) gst rate in canada is 5% and pst. This can be useful either as merchant or a. As of july 1, 2016 the hst rate increased from 13% to 15%. The rates for pst differ across provinces, and some territories have no pst at all.

From dxolzyuhu.blob.core.windows.net

Gst/Hst Rates 2020 at James Lynch blog Gst Hst Rate British Columbia calculate the gst (5%) & pst (7%) amounts in bc by putting either the after tax or before tax amount. The rates for pst differ across provinces, and some territories have no pst at all. Current (2024) gst rate in canada is 5% and pst. Currently, there are five provinces in canada using the hst system. 5% (gst) in. Gst Hst Rate British Columbia.

From empirecpa.ca

How To File Your GST/HST Return Empire CPA Gst Hst Rate British Columbia sales tax rates by province. 5% (gst) in alberta, british columbia, manitoba, northwest territories, nunavut, quebec,. Here is an overview of the hst rates by province: hst rates vary by province, ranging from 13% to 15%. Currently, there are five provinces in canada using the hst system. As of july 1, 2019 the pst rate was reduced from. Gst Hst Rate British Columbia.

From www.alamy.com

Gst hst hires stock photography and images Alamy Gst Hst Rate British Columbia As of july 1, 2019 the pst rate was reduced from 8% to 7%. it will help you figure out taxes broken down by gst/hst/pst and by province. The rates for pst differ across provinces, and some territories have no pst at all. Current (2024) gst rate in canada is 5% and pst. Currently, there are five provinces in. Gst Hst Rate British Columbia.

From farrukhahmed.ca

Need Help GST HST Filing Mississauga? Farrukh Ahmed, CPA Gst Hst Rate British Columbia The rates for pst differ across provinces, and some territories have no pst at all. enter gst/pst inclusive price and calculate reverse gst and pst values and gst/pst exclusive price. the current rates are: Current (2024) gst rate in canada is 5% and pst. Provinces that do not use hst levy their own separate pst alongside the federal. Gst Hst Rate British Columbia.

From exozladap.blob.core.windows.net

Poster Printing Gst Rate at Leora Labrie blog Gst Hst Rate British Columbia Currently, there are five provinces in canada using the hst system. enter gst/pst inclusive price and calculate reverse gst and pst values and gst/pst exclusive price. hst rates vary by province, ranging from 13% to 15%. Current (2024) gst rate in canada is 5% and pst. 5% (gst) in alberta, british columbia, manitoba, northwest territories, nunavut, quebec,. See. Gst Hst Rate British Columbia.

From castlellp.com

GST Calculator for BC Real Estate Castle Law LLP Gst Hst Rate British Columbia As of july 1, 2019 the pst rate was reduced from 8% to 7%. There are three types of sales taxes in canada: Provinces that do not use hst levy their own separate pst alongside the federal gst. it will help you figure out taxes broken down by gst/hst/pst and by province. the current rates are: The rates. Gst Hst Rate British Columbia.

From www.todocanada.ca

GST/HST Credit How Much You Will Get From July 2023 to June 2024 Gst Hst Rate British Columbia sales tax rates by province. enter gst/pst inclusive price and calculate reverse gst and pst values and gst/pst exclusive price. Provinces that do not use hst levy their own separate pst alongside the federal gst. calculate the gst (5%) & pst (7%) amounts in bc by putting either the after tax or before tax amount. There are. Gst Hst Rate British Columbia.

From www.zoho.com

Canada GST/HST Returns Help Zoho Books Gst Hst Rate British Columbia There are three types of sales taxes in canada: See below for an overview of sales tax amounts for each province and territory. Provinces that do not use hst levy their own separate pst alongside the federal gst. As of july 1, 2019 the pst rate was reduced from 8% to 7%. hst rates vary by province, ranging from. Gst Hst Rate British Columbia.

From www.cpatraining.ca

Introduction to GST/HST and Practice 5 Real Client GST/HST Returns Gst Hst Rate British Columbia The rates for pst differ across provinces, and some territories have no pst at all. the current rates are: it will help you figure out taxes broken down by gst/hst/pst and by province. calculate the gst (5%) & pst (7%) amounts in bc by putting either the after tax or before tax amount. enter gst/pst inclusive. Gst Hst Rate British Columbia.

From synder.com

GST/HST Essentials for Foreigners How Canadian Taxes Work Gst Hst Rate British Columbia There are three types of sales taxes in canada: As of july 1, 2019 the pst rate was reduced from 8% to 7%. enter gst/pst inclusive price and calculate reverse gst and pst values and gst/pst exclusive price. the current rates are: Here is an overview of the hst rates by province: calculate the gst (5%) &. Gst Hst Rate British Columbia.

From emergencydentistry.com

Harmonized Sales Tax British Columbia Clearance Gst Hst Rate British Columbia The rates for pst differ across provinces, and some territories have no pst at all. calculate the gst (5%) & pst (7%) amounts in bc by putting either the after tax or before tax amount. Provinces that do not use hst levy their own separate pst alongside the federal gst. 5% (gst) in alberta, british columbia, manitoba, northwest territories,. Gst Hst Rate British Columbia.

From www.pdffiller.com

Fillable Online British Columbia New Housing Rebate GST/HST Info Gst Hst Rate British Columbia Here is an overview of the hst rates by province: enter gst/pst inclusive price and calculate reverse gst and pst values and gst/pst exclusive price. Provinces that do not use hst levy their own separate pst alongside the federal gst. Currently, there are five provinces in canada using the hst system. 5% (gst) in alberta, british columbia, manitoba, northwest. Gst Hst Rate British Columbia.

From www.connectcpa.ca

GST AND HST SALES TAX RATES BY PROVINCE IN CANADA — ConnectCPA Gst Hst Rate British Columbia As of july 1, 2016 the hst rate increased from 13% to 15%. Here is an overview of the hst rates by province: There are three types of sales taxes in canada: it will help you figure out taxes broken down by gst/hst/pst and by province. 5% (gst) in alberta, british columbia, manitoba, northwest territories, nunavut, quebec,. Provinces that. Gst Hst Rate British Columbia.

From www.edelweiss.in

the central government has provided states uts a total of inr Gst Hst Rate British Columbia Currently, there are five provinces in canada using the hst system. Current (2024) gst rate in canada is 5% and pst. 5% (gst) in alberta, british columbia, manitoba, northwest territories, nunavut, quebec,. hst rates vary by province, ranging from 13% to 15%. sales tax rates by province. There are three types of sales taxes in canada: the. Gst Hst Rate British Columbia.

From www.bizstim.com

Help with HST and GST Rates in Canada Bizstim Gst Hst Rate British Columbia There are three types of sales taxes in canada: As of july 1, 2016 the hst rate increased from 13% to 15%. hst rates vary by province, ranging from 13% to 15%. it will help you figure out taxes broken down by gst/hst/pst and by province. This can be useful either as merchant or a. sales tax. Gst Hst Rate British Columbia.

From dokumen.tips

(PDF) General Information for GST/HST Registrantson Transitional Rules Gst Hst Rate British Columbia sales tax rates by province. Here is an overview of the hst rates by province: The rates for pst differ across provinces, and some territories have no pst at all. As of july 1, 2019 the pst rate was reduced from 8% to 7%. There are three types of sales taxes in canada: Currently, there are five provinces in. Gst Hst Rate British Columbia.

From slideplayer.com

Accounting for Startups ppt download Gst Hst Rate British Columbia enter gst/pst inclusive price and calculate reverse gst and pst values and gst/pst exclusive price. See below for an overview of sales tax amounts for each province and territory. As of july 1, 2016 the hst rate increased from 13% to 15%. 5% (gst) in alberta, british columbia, manitoba, northwest territories, nunavut, quebec,. This can be useful either as. Gst Hst Rate British Columbia.

From gytd.cpa

Understanding the Quick Method of GST/HST Filing GYTD CPA Tax Gst Hst Rate British Columbia Provinces that do not use hst levy their own separate pst alongside the federal gst. See below for an overview of sales tax amounts for each province and territory. As of july 1, 2016 the hst rate increased from 13% to 15%. This can be useful either as merchant or a. The rates for pst differ across provinces, and some. Gst Hst Rate British Columbia.